The Republican-controlled Congress is in the final stages of

writing the most sweeping tax changes in forty years. The Senate version of the tax bill is 487

pages, which is hardly the sweeping simplification promised by Republicans, and

too long to easily summarize in this paragraph.

Business taxes are affected far more than individual taxes. Specifics of

the tax bill are summarized at the end of this article.

The main focus of the tax reform is lower taxes for

corporations. The pretext is that lower

taxes on corporations will result in economic growth, but the real goal is to

lower taxes on unearned income. Profits

saved through lower taxes will flow through corporations to shareholders,

including Republican Party donors. The

expectation of higher dividends and capital gains has driven the stock market

by more than 25% since the election.

Most, if not all, serious economic reviews of the tax plan

do not support the expectation of higher economic growth. The Congressional Joint Committee on Taxation

concluded that the bill would only add marginally to economic growth, while

adding one trillion dollars to the US Federal debt, even after accounting for

the additional tax revenue resulting from growth. And both private and JCT analyses conclude that

tax benefits will accrue to the wealthiest Americans, with poorer Americans

losing money.

--

--

Justification for 2017

Corporate Tax Cut

The rationale for the deep cut in corporate taxes is based

on the idea that higher after-tax profits for corporations will result in a higher rate of economic growth. Also, the argument is that a higher rate of growth will be shared by wage-earners in the form of higher take-home pay.

Let’s look at that idea.

United States Corporate Taxes Compared to the OECD

In justifying the corporate tax cut, both of Alaska's Senators have said that American corporate taxes are "among the highest in the world". They believe those high taxes render our corporations noncompetitive in global markets. As this blog has previously noted, a quick trip to the OECD database shows that idea is simply false. Although US nominal corporate taxes are comparatively high, the corporate tax actually paid in the United States is less than the average for the OECD.

GDP Growth, Corporate Taxes, After-Tax Profits and Wages

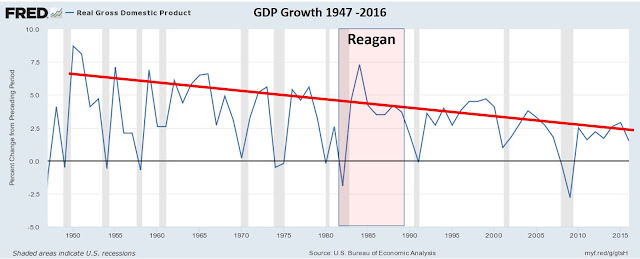

The premise that higher after-tax corporate profits lead to higher economic growth and higher wages is false. American economic growth has been declining since World War II.

--

Tax Cuts and the Reagan Economy

The final argument for tax cuts is that tax cuts worked in the past. The basis for that claim is generally in the mythology surrounding tax cuts enacted in 1981 and 1987 during the Reagan administration. Close examination proves that economic growth during the Reagan administration was not extraordinary, and the growth that did occur was largely due to other factors. The actual performance

of those tax cuts is complicated by eleven tax hikes that were also passed

during the Reagan years, for the purpose of restoring lost revenues.

Let’s look at the Reagan economy.

Let’s look at the Reagan economy.

First, the “economic boom” of the Reagan years looks less

spectacular when viewed in the context of the total post-war economy. American economic growth has been falling

steadily since World War II, part of a general structural problem in the U.S.

economy, reflected in GDP growth, wages as a share of the economy, and the time

required for recovery after recessions. [That

should be the topic of another blog post.]

There were really only two years during the Reagan administration that had

economic growth above the long-term, non-recessionary trend (1983 and 1984).

Still, the Reagan administration was marked by a period of fairly persistent and strong growth. There are three reasons for that growth.

Still, the Reagan administration was marked by a period of fairly persistent and strong growth. There are three reasons for that growth.

1) Interest Rates

I believe that the main reason for sustained growth during the Reagan

years was falling interest rates. Interest

rates reached a singular, extraordinary peak in 1981 (see chart). The Volcker Federal reserve had largely quelled

inflation by 1981, and began to let interest rates fall. The extraordinarily high interest rates at

the peak probably caused the multiple recessions of 1980 – 1982. As interest rates fell, economic growth which

had been bottled up by high rates was released.

I believe the influence of falling rates far exceeded the influence of

lower taxes.

2) Serendipity

Secondly, there is simply the matter of good timing. The Reagan administration was faced with

recessions in 1981 and 1982, but afterwards enjoyed the benefit of the typical

eight-to-ten year business cycle. There

is no particular policy which can be attributed to this aspect of success,

except luck. [See previous chart, with indicated recessions.

3) Tax Cuts

Tax cuts do provide stimulus to the economy, and the Reagan tax cuts of

1981 were appropriately given during an economic recession. Ultimately, though, tax cuts are literally

borrowing against the future, and must someday be paid back in terms of later

economic growth. I believe that it is

best to run budgetary surpluses when there is strength in the economy, to allow

the government the ability to incur deficits when the economy is weak, without fear

of destabilizing the economy. The Reagan

administration never fully funded the government to pay for the deficits it

incurred.

The 2017 Republican Tax Reform Plan

The

Republican Tax Plan passed by the House and the Senate must now be reconciled

into a single bill. The bills are very

similar in scope, and the process should not result in significant changes to the

plans, except where major errors are discovered in the assumptions and

provisions of the bill.

My

main objections to the plan are as follows:

1) Debt

The plan runs large federal deficits, at a time when the total Federal

debt is approaching 100% of annual GDP, and interest payments are starting to

become a significant part of annual spending.

2) Timing

The plan cuts taxes at a time of full employment, when fiscal policy

should be to run surpluses.

3) Corporate Taxes

The plan awards long-term tax relief to corporations, at a time when

corporate taxes are already low; corporate earnings are already soaring, and no

gains in GDP have been observed.

4) Lack of Middle-Class Tax Relief/Benefits

for Unearned Income

Individual tax relief in the plan will accrue mostly to high income families,

particularly those with unearned income.

The corporate tax reduction will flow through to investors, much more

directly than to wage-earners.

5) Abolishes ACA Individual Mandate

The

tax plan eliminates the individual mandate aspect of the Affordable Care

Act. It is considered an important facet

of the act, in encouraging younger people to participate in the insurance

pool.

Conclusion

The Republican tax plan is based on false ideas: that American corporate taxes are higher than other countries; that higher corporate taxes produce higher economic growth and higher wages; that general tax cuts during the Reagan administration produced extraordinary growth. All of these ideas can be demonstrated to be false, using economic data that is available to anyone.

Lower corporate taxes increased profits, not wages.

The Republican tax plan will probably become law. I expect that it is unlikely to survive the next administration and Congress. But the debts incurred before it is overturned will last for a generation.

A copy of this post is available on my political blog, http://debatablypolitical.blogspot.com/.

Lower corporate taxes increased profits, not wages.

The Republican tax plan will probably become law. I expect that it is unlikely to survive the next administration and Congress. But the debts incurred before it is overturned will last for a generation.

A copy of this post is available on my political blog, http://debatablypolitical.blogspot.com/.

------

Appendix

Summary of Important Changes

in the Republican Tax Reform Bill

Business Tax Changes

1) Drops the nominal corporate income tax rate from 35% to 20%. The current Senate bill, perhaps through an oversight, keeps the minimum corporate tax at 20%, eliminating exemptions by default. It is expected that the reconciliation bill will restore those exemptions, dropping the actual corporate rate below 20%.

1) Drops the nominal corporate income tax rate from 35% to 20%. The current Senate bill, perhaps through an oversight, keeps the minimum corporate tax at 20%, eliminating exemptions by default. It is expected that the reconciliation bill will restore those exemptions, dropping the actual corporate rate below 20%.

2) The tax rate for “pass-through” small businesses is

reduced, excepting service businesses such as lawyers, accountants, and

doctors. The amount of the reduction is

to be determined in reconciliation.

3) Rules for

expensing, rather than capitalizing, spending are relaxed, allowing quicker

realization of tax benefits from business investment.

4) Repatriated

profits from foreign operations would be taxed at a much lower rate than US

profits. Cash assets would be taxed at

10% (Senate) or 14% (House), while non-cash assets would be taxed at 5%

(Senate) or 7.5% (House).

Individual Tax Changes

5) All classes of individual taxpayers will see a tax

reduction in the near term, but those reductions will expire in ten years. On the other hand, business tax reductions

will be permanent.

6) The standard deduction is doubled, but personal

exemptions are eliminated. Child tax

credits are increased, but the full value is only available to those with

higher income to offset taxes. For large

families, the child tax credit may not fully offset the loss of personal

exemptions.

7) State & local

tax deductions are eliminated; casualty loss deductions are eliminated. The mortgage interest deduction is retained

for all but the largest mortgages.

8) The estate tax may be eliminated, or the minimum

threshold for the estate tax may be doubled.

9) The individual

mandate tax of the ACA is repealed. Some

fear that this will destabilize the insurance markets, by removing a large

number of younger, healthy individuals from the insurance pool.

10) The fate of the Alternative Minimum Tax will be

determined in reconciliation.

11) Waived tuition, common for graduate students, will now

be taxed. Colleges with very large

endowments will have some earnings taxed.

Other

12) Drilling will be allowed in the Arctic National Wildlife

Refuge Area 1002, which was originally set aside for consideration for oil

development.

--

--

Appendix 2

As this blog has previously noted, American Federal taxes

are among the lowest in the world, in direct contrast to Republican claims that

American taxes are among the highest in the world. Here is data from OECD and the World Bank,

showing the relative ranking of American Federal taxes compared to other

countries.

United States Federal taxes as a share of GDP, compared to 34 OECD countries.

United States Federal taxes compared to 123 other countries; data from World Bank.

Countries with lower Federal taxes than the United States

are Ethiopia, Pakistan, India, Afghanistan, Bangladesh, Central African

Republic, West Bank and Gaza, Lithuania, Oman, Nigeria, Bahrain, Estonia,

United Arab Emirates.

--

References

Summaries of the Republican Tax

Plan

Washington Post

Forbes

CNN

Economic Reviews of the Tax

Plan

Tax Policy Center – the plan will ultimately raise taxes on

more than half of Americans.

University of Chicago Survey – only one out of 42 economists

believes that the plan will significantly grow the economy.

University of Pennsylvanian/Wharton review – the tax plan will add about $1.3 trillion to the national debt.

University of Pennsylvanian/Wharton review – the tax plan will add about $1.3 trillion to the national debt.

This article attempts to put lipstick on a pig. The article acknowledges that economic growth

from the tax plan will be small, “but significant”. The article recognizes that slower growth has

occurred in the past two decades, when progressively slower growth has actually

been going on for seven decades. The

article gives no explanation for why growth is slower now than in the past, or

why tax cuts at a time of full employment will help.

A Federal tax expert says that the tax plan is stupid.

Historical Data

OECD tax on corporate profits

US corporate tax among the lowest in the OECD

Corporate Tax as share of GDP

Source of federal revenue

FRED

Thank you for sharing! This article is really helpful and informative.

ReplyDeleteIn earlier times, and again today, governments have utilized taxation for other than merely fiscal purposes.

ReplyDeleteTax specialist in Manchester