According to Hubbert’s theory, Peak Oil should occur when half of the global oil endowment has been produced. We explored this idea in the first post of the Peak Oil series. Cumulative production to date through 2011 has been about 1365 billion barrels. Production has not yet peaked, which implies a global endowment of over 2730 billion barrels. This number is reasonable, considering the USGS mean estimate of 3000 billion barrels, and high estimate of 3900 billion barrels for the recoverable global oil endowment.

We know very well that oil discoveries peaked in the 1960’s. Why then, is it so difficult to quantify the global endowment of oil? Let’s look at the work of two researchers, Fredrik Robelius and Richard Nehring.

Recognition Lag

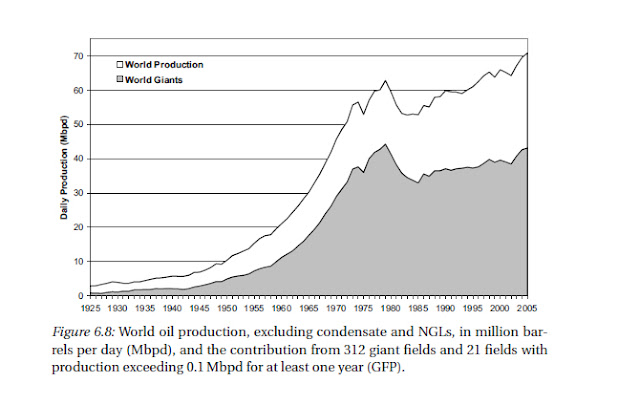

Fredrik Robelius wrote a very important contribution to the theory of Peak Oil as a PhD thesis at Uppsala University in 2007. I will use only a single figure from that thesis at this time, but I hope to write more about it in a later post.

Robelius’ figure shows volumes of global oil discoveries, by the year of discovery. Reserve estimates are back-dated to the year of discovery, and clearly shows the peak of oil discoveries around 1960, and the cross-over, when global production exceeded volumes of new discoveries about 1985. Robelius’ figure shows another interesting dimension which is seldom presented: the volumes of reserve growth in old fields. Estimates made about a decade apart, in 1994 and 2005, show large positive revisions to previous estimates; “new” reserves in old fields.

Reserve growth is well-known and expected. There are various reasons for reserve growth: revisions to estimates of oil in-place, production performance data, additional drilling, step-outs and field extensions, secondary and tertiary recovery technologies and investments, and the innate pessimism of reserve estimates by Production Department engineers(as opposed to the innate optimism of reserve estimates by Exploration Department geologists). In particular, proved reserves estimates are expected to be of reasonable certainty, according to both law and professional practice. According to guidance provided by staff of the United States Securities and Exchange Commission, upward reserve revisions should be much more likely than downward revisions.

In the 1980’s, Richard Nehring realized that a number of years may pass before a field is fully evaluated, and that the reserves are estimated correctly. In the paper “What Really Happened in 1986”, Nehring coined the term “recognition lag” to describe the phenomenon. Most reserve growth happens in the first few years of field delineation, but we see in Robelius’ chart that fields discovered in 1960 had about 100% reserve growth, doubling the total oil endowment, 35 years after discovery! Some researchers have attempted to derive a formula to estimate the volume of reserve growth in later years. However, I believe that reserve growth is too random to develop meaningful predictions from early trends.

Reserve Growth

Nehring has recently concentrated on the idea of reserve growth through improvements in recovery efficiency (“Recovery Growth”), which is the recoverable fraction of oil in the ground. I greatly respect Nehring's work and insight, but believe the estimates he presents are too high. Furthermore, he should not simply add the low and high estimates in each category to obtain the low-to-high range. These should be combined using a probabilistic approach.

Nehring presents a range of the world oil endowment with a low, middle and high estimates of 3270 – 4290 – 5620 billion barrels. By comparison, the USGS range of estimates is 2250 – 3000 – 3900. Nehring’s higher estimates depend largely on his assumptions about recovery growth. His low, medium and high ranges (715 – 1095 – 1585 Bbbls) represent assumed global average recovery factors of 35% - 40% - 45% of original oil in place. Nehring says that this will take 50 to 80 years to realize.

Based on experience and technical reading, I find Nehring’s recovery range too high. Global giant oilfields are currently at about 22% recovery, and are expected to reach ultimate recoveries of 30% to 35%. There is a fair amount of complexity to the issue. Fields in carbonate reservoirs represent about 60% of remaining oil. Recoveries in carbonate fields are highly variable, like the reservoirs, and I find contradictory numbers for expected average recovery, with the low side between 20 – 25%, and the high side at 36% (SPE paper 84459).

There are physical, technical, and economic limits to increasing oil recovery. Oil can be withdrawn from a reservoir, but the saturation of oil approaches a limit called the irreducible saturation, at which oil will no longer move through the pore system. Reservoir heterogeneity also limits the physical recovery possible from a reservoir. Low porosity,smaller reservoirs offshore or remote locations, and great drilling depth all tend to reduce the technical and economic recovery of oil. However, these are characteristic of many of the remaining developing oil fields. Examples include Tengiz and Kashagan in Kazakhstan, fields of the Russian arctic, undeveloped fields of the Middle East. I expect relatively lower fractional recovery from these fields than earlier discoveries. The law of diminishing returns is alive and well, and I expect global average recovery to be about 35%. This would support the low end of the range proposed by Nehring on recovery growth, of about 700 billion barrels.

As an aside, the low-medium-high ranges proposed by Nehring for independent variables should not be added as simple sums. These uncertainty ranges should be added stochastically, which will result in a narrower distribution.

Fredrik Robelius, Giant Oil Fields – The Highway to Oil

http://uu.diva-portal.org/smash/record.jsf?pid=diva2:169774

Richard G. Nehring, Peak Oil: Why, When, and How

Other references

EOR projects are not suited to offshore, deep, small, heavy or unconventional reservoirs.

Global recovery factors are expected to ultimately be 30 – 35%.

Recovery factors in high-quality uniform sandstone reservoirs after secondary recovery may be 40 to 60%; but the norm is considerably lower. In chalk limestone fields is generally in the low 20’s.

60% of remaining oil is in carbonate fields.

The overwhelming majority of proven oil in the Middle East is in carbonate reservoirs

Recovery in fractured carbonate reservoirs is 20% - 25%.

Overall, the carbonate oil reservoirs have an average ultimate recovery factor of 36%.

SPE 84459

Often noted that most reserve growth occurs in first 6 years after discovery.